The Chicken Tax & The Washing Machine Tariff: Two Perfect Examples of Economic Self-Sabotage

How a 1960s poultry feud left Americans driving gas-guzzlers, and Trump's tariff tantrum made laundry day more expensive.

“The only thing worse than a government monopoly is a private monopoly protected by the government.” – unknown

Imagine a trade war so ill-conceived that it made pickup trucks artificially expensive for decades, or perhaps even worse, left them untarnished by progress, while turning your laundry room into a financial drain. Welcome to the world of tariffs, where protectionism often backfires, and the ones who suffer most are the consumers.

Do you ever wonder why the Toyota Hilux, Nissan Navara, Isuzu D-Max, or even the Volkswagen Amarok aren’t running around the plains of Texas or the farms of Montana? Is it because the United States builds a far superior pickup truck? Or is the country stuck in some kind of Cuban dystopia of 1970s pickup trucks, where outdated designs reign supreme simply because foreign competitors were locked out decades ago? If these trucks can dominate in Europe, Africa, and Australia, handling rugged terrains, long hauls, and extreme conditions, then why are American buyers denied the chance to choose? Spoiler alert: it’s not because Ford and GM are making the best trucks on the planet. It’s because the Chicken Tax boxed out competition so long ago that we never got to see what actual market forces might have created.

I first heard about the Chicken Tax on an episode of Planet Money several years ago, and I’ve been fascinated by it ever since. A tariff named after poultry that still haunts the American auto industry? That’s the kind of ridiculousness that sticks with you. It’s one of those stories that perfectly illustrates how a government policy, intended as a temporary tantrum, can spiral into a multi-decade economic absurdity. And since I can’t be the only one who enjoys a good “how did we get stuck with this nonsense?” story, I figured I’d share it with you.

For the past 60 years, the United States has occasionally inflicted economic wounds upon itself, often under the guise of protecting American jobs. Two standout examples are the Chicken Tax and Trump’s Washing Machine Tariff, policies that have had lasting, unintended consequences and remain masterclasses in how tariffs can go hilariously wrong.

The Chicken Tax: A Lingering Trade War Relic

In the early 1960s, the U.S. dominated the poultry market, leading European nations like France and West Germany to impose tariffs on American chicken imports. President Lyndon B. Johnson, in true Texan fashion, didn’t take kindly to this and retaliated with a 25% tariff in 1964 on several goods, most notably light trucks. The primary target? Volkswagen’s Type 2 pickup, a beloved workhorse that had been making American automakers sweat.

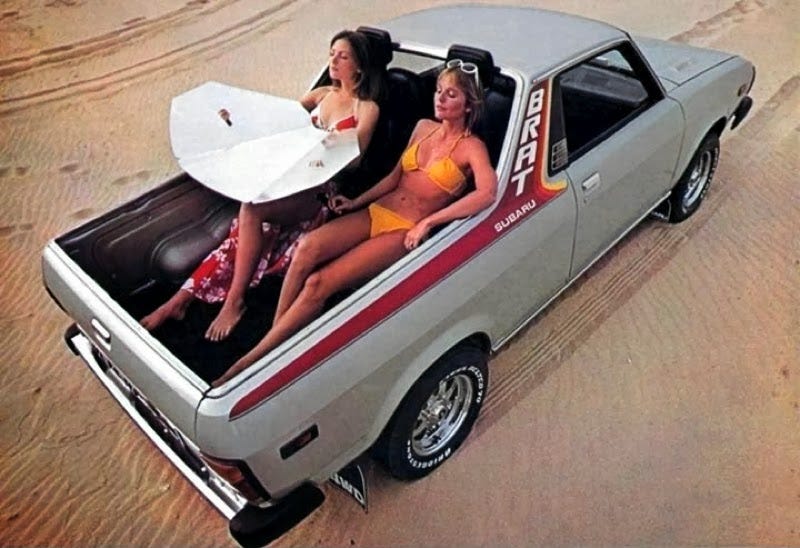

And then came the circus of tariff avoidance. Automakers got creative. Subaru, in a stroke of either genius or desperation, slapped tiny plastic seats in the bed of the BRAT to classify it as a “passenger vehicle.” Ford, never one to back down from a bureaucratic brawl, started shipping Turkey-assembled Transit Connect vans into the U.S. as passenger vehicles, complete with rear seats, only to rip them out as soon as they cleared customs. The seats, mind you, were sometimes shipped back and forth across the border in separate containers just to dodge the tax. This wasn’t a trade policy; it was a tragicomedy with no intermission.

Trump's Washing Machine Tariff: Spinning Into Higher Costs

Fast forward to 2018, and another trade war maestro, Donald Trump, decided that American washing machine manufacturers needed protection from foreign competition. His solution? Slap tariffs on imported washers, forcing consumers to buy American-made machines. The logic was as airtight as a sieve, but the result was exactly what you’d expect.

Sure, Whirlpool added 1,800 new jobs, which sounds great, until you realize that each one of those jobs came at a cost of $820,000 to American consumers. That’s right. For the money spent on protecting a few factory positions, we could have just handed each worker a check for three-quarters of a million dollars and called it a day.

And if you thought that was bad, here’s the real kicker: the tariffs didn’t just make washing machines more expensive; they jacked up the price of dryers, too. Even though dryers weren’t targeted by the tariff, retailers knew that people buy washers and dryers in pairs, so they conveniently raised prices on both. The end result? American consumers shelled out an extra $1.5 billion. That’s not an economic policy, it’s an extortion racket with spin cycles.

The Takeaway: Tariffs Are the Gift That Keeps on Taking

Both the Chicken Tax and Trump’s washing machine tariffs prove that economic nationalism often backfires. Instead of helping workers, these policies distort markets, drive up costs, and force businesses into absurd contortions just to stay competitive.

The next time you find yourself overpaying for a pickup truck or a household appliance, remember: it might not be just inflation at play, it could be the lingering effects of a government blunder that should have been scrapped decades ago. But hey, at least we got some great loopholes and bureaucratic gymnastics out of it.

Fascinating stuff. Sone of this was news to me.